Money is one of the leading causes of conflict in relationships. Whether it’s about everyday expenses, savings goals, debt, or differences in financial philosophy, money can quickly become a source of tension. Even couples who deeply care for each other can find themselves at odds when financial stress enters the picture.

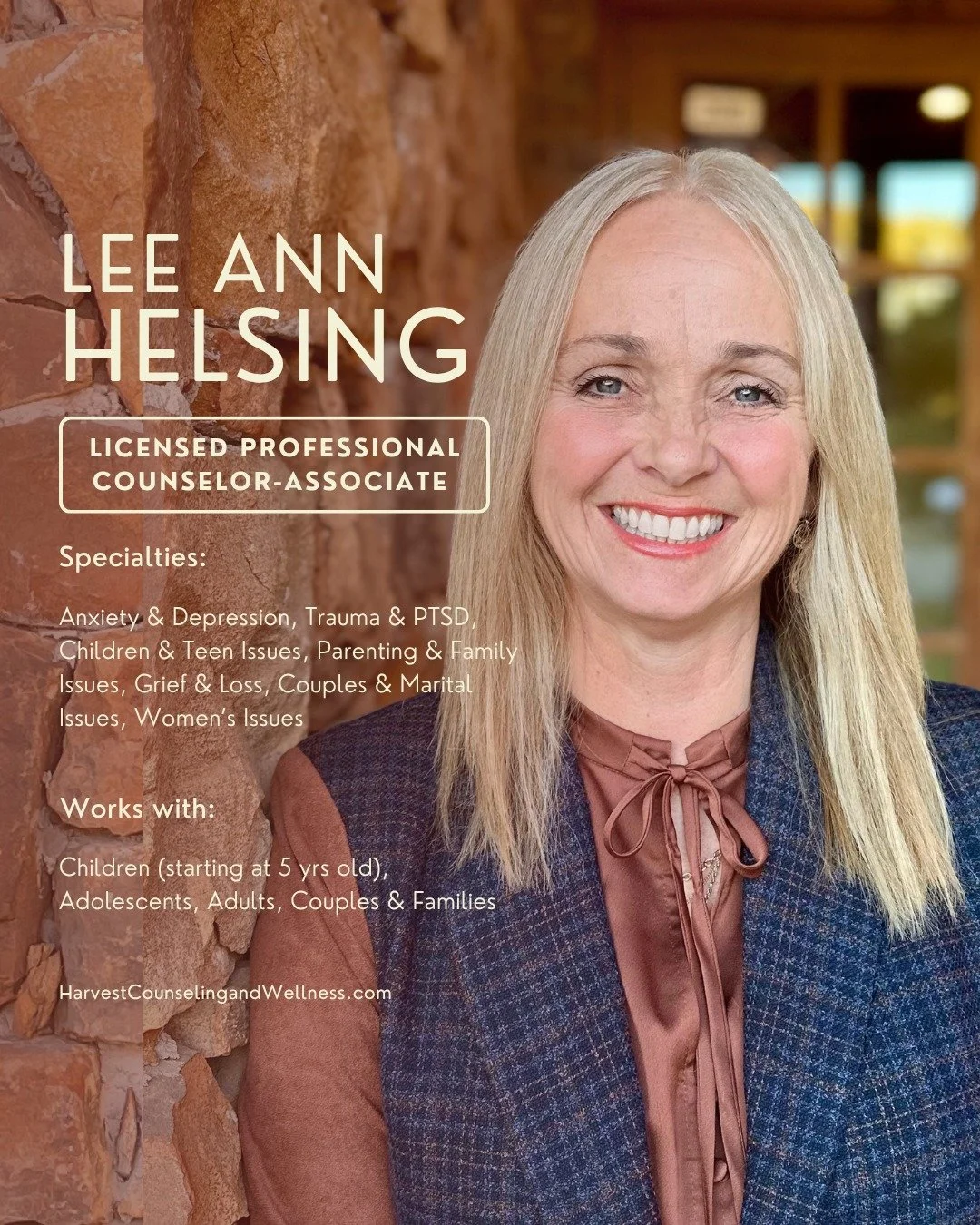

At Harvest Counseling & Wellness in Argyle, TX, we work with couples from across Denton County and the DFW area to navigate conflict in a healthier, more connected way—including stress around money.

Common Causes of Financial Stress in Relationships

Every couple has a financial story. Often, the friction around money isn’t just about the dollars and cents—it’s about the emotions, values, and expectations that come with them. Here are some common triggers of financial stress:

Different spending styles: One partner may be more frugal, while the other is comfortable spending more freely.

Debt and financial obligations: Student loans, credit cards, or unexpected bills can create strain.

Job loss or income imbalance: When one partner earns significantly more, it can affect decision-making and control dynamics.

Prenuptial agreements: While these agreements are increasingly common, they can stir up feelings of mistrust, fear, or insecurity if not approached carefully and with open communication.

Lack of shared financial planning: Without clear goals or a budget, couples often feel disconnected and overwhelmed.

Family financial responsibilities: Supporting children from a previous relationship, aging parents, or relatives can bring added complexity.

Understanding the source of the stress is the first step toward finding solutions.

How Financial Stress Impacts Relationships

Unchecked financial stress often leads to deeper emotional disconnection. You may notice:

Increased arguments or avoidance: Conversations about money can turn tense or be avoided altogether.

Loss of intimacy: Emotional or financial tension often leads to reduced closeness and physical connection.

Trust issues: Secrecy about spending, hidden debts, or one-sided decision-making can erode trust.

Emotional burnout: Constant financial worry takes a toll on your mental and emotional well-being, and that affects how you relate to each other.

These symptoms don’t mean your relationship is broken—they’re signs that your financial stress deserves attention and support.

Healthy Communication Around Money

Talking about money isn’t always easy, especially if past conversations have ended in conflict. But open, respectful dialogue is key to moving forward.

Set a regular time for financial check-ins: Pick a calm, predictable time to talk about budgets, bills, or shared goals.

Use “I” statements: “I feel anxious when we don’t discuss our expenses” is more productive than “You never stick to the budget.”

Understand each other’s financial history: Ask about how your partner’s family approached money growing up. These early experiences shape adult attitudes.

Avoid blame: Money problems are often shared, not caused by one person. Focus on working as a team.

Practical Ways to Reduce Financial Stress as a Couple

Working together to reduce stress around money can actually deepen your bond. Here are some actionable steps:

Create a joint budget: Whether you fully combine finances or keep separate accounts, knowing where your money goes each month is essential.

Set short- and long-term goals: Talk about what you want to accomplish—paying off debt, saving for a home, building a safety net.

Start an emergency fund: Having even a small cushion can ease anxiety and reduce conflict.

Use tools to stay organized: Budgeting apps can help you track spending, plan ahead, and reduce surprises.

Play to your strengths: One partner might be better at details, while the other brings vision. Divide responsibilities in a way that feels balanced.

Celebrate progress: Recognize when you pay off a debt, stick to a budget, or reach a savings goal. These moments build trust and encouragement.

When Prenuptial Agreements Cause Tension

Prenuptial agreements can be wise financial tools—but if they’re not handled with mutual understanding, they can introduce relational strain. If one partner feels the agreement is unfair, unclear, or rooted in distrust, it can create ongoing emotional distance. Counseling provides a space to talk through the emotional impact of these agreements and clarify expectations moving forward.

When to Consider Couples Counseling

You don’t need to be on the brink of separation to benefit from counseling. Many couples seek support simply because they’re tired of arguing or feeling distant. It might be time for couples counseling if:

You argue about money often, and nothing seems to get resolved

You avoid financial conversations altogether

One or both of you feels anxious, overwhelmed, or shut out

You’re struggling to agree on long-term financial goals

A prenuptial agreement continues to be a source of tension

At Harvest Counseling & Wellness, we help couples develop communication tools, strengthen trust, and navigate conflict with compassion and clarity.

Your relationship is worth the investment.

Is financial stress is getting in the way of your connection?

We offer in-person and telehealth sessions to couples throughout Argyle, Denton, Flower Mound, Northlake, Highland Village, Southlake, and nearby communities. Our team understands that financial stress can touch every part of your relationship, and we’re here to help you grow through it—not just get through it.

Whether you’re dealing with budgeting disagreements, income gaps, or the emotional tension of a prenuptial agreement, you don’t have to face it alone. Call us today at (940) 294-7061.